Establishing an accurate home value of a property is one of the most important service a real estate adviser offers. There are many things that go into calculating the price range – What is a CMA – and all of us have multiple ways to do it (be happy to share the process with you, just ask contact me button hoes here). But the most part of this process happens probably before I even sit down to do it – it happens when I see the house and talk to the seller. Only by doing this I’ll find the most accurate information about the house itself and only AFTER that I start the actual analysis, get the tax records, etc. And this is where the Zestimate, Redifin Estimate and literally every other AVM (Automated Valuation Model) comes short.

In order to understand this better, let’s start from beginning by explaining what these automated home estimates are and what they are not, I’ll use Redfin and Zestimate as examples, since they are probably the most popular at the moment.

What is Redfin Estimate?

It’s a calculation of a house market value that is determined by a proprietary algorithm. That algorithm is based on recently sold properties, as well as all the data about those properties they can get from MLS[1]. Redfin is very careful to point out that their estimate is just a starting place and it’s not an actual appraisal or a CMA done by an agent[2]. But they also claim that their estimator is the most accurate on the market. So, let’s take a look at their own table and analyze the presented numbers.

The table above is for houses that are active, meaning they are already on the market being actively sold. In DC their average median error is 1.54%, but then if you look further some estimates are within 5% margin of error, 15.54% to be exact. Then 4.48% are within 10% and only 0.91% are within 20% margin of error. So statistically the numbers don’t look so bad, but let’s put some numbers on them on them. Average home price in DC is $635,000[1], so even a 1.54% error means close to 10K, but how about those 15.54% homes where the margin of error is 5%?

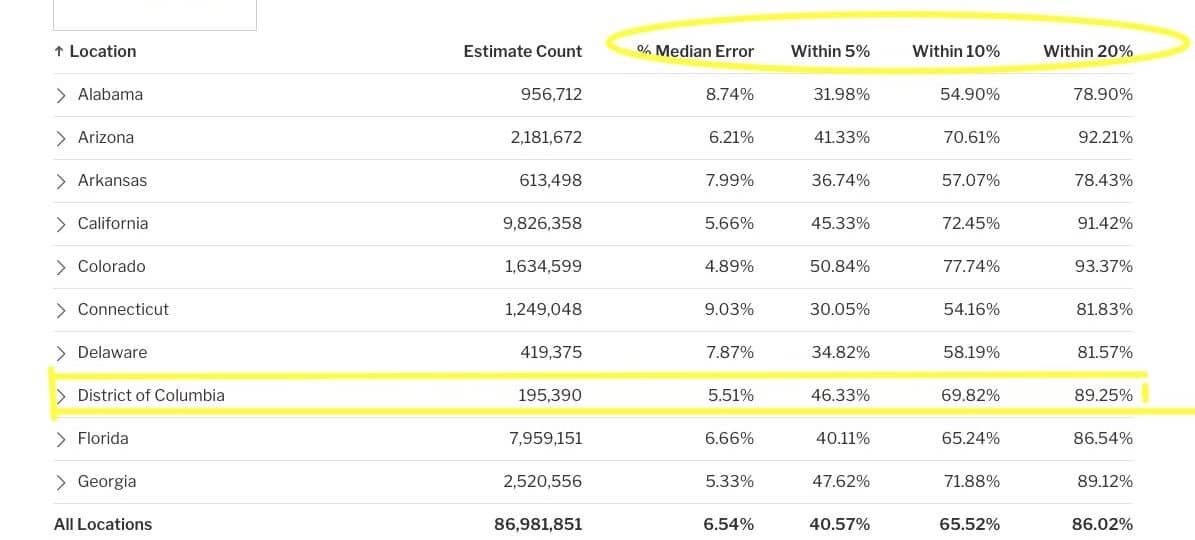

Redfin’s estimator makes differentiates between Active and Off-Market properties (whereas Zillow doesn’t) the table above is for the houses that are already on the market, how about the ones that are off-market? Which I’d argue is a more important stat since most potential sellers want to find their value before they put the house on the market.

Here we can see that the median margin of error is higher and the accuracy numbers of margin error within 5,10, and 20% drops dramatically.

Now onto Zestimate – which is probably the best-known online estimator. Zestimate covers about 100 million houses all over United States and their algorithm uses physical attributes, tax records, and user submitted data in order to come up with a value estimation. Zillow doesn’t seem to report their numbers the way Redfin does, but they report that their margin of error is about 4.3% nationally and that’s down from what it used to be at 5%, after their recent Zestimate algorithms makeover. I couldn’t find a more accurate number for our region, so let’s assume that 4.5% is the median for Greater DC area too. How much cash would a seller leave on the table if the error is 4.5%? Since we are talking about Greater DC area, I will go with the median house price in US, which according to the latest numbers, is $340,000, which means that that 4.5% margin error could potentially cost a seller over $15,000…

So why are the margins of error for Redfin and Zestimate so different? For one it’s because Zillow provides data for more homes than Redfin. So, Redfin can look at more details than Zillow can, and more data also means there is more room for mistakes. Zillow also doesn’t provide different accuracy metrics for on and off market homes like Redfin does, which really means that their margin of error has to be higher to account for active homes and the properties that haven’t been sold in years.

Now is the time to go back to the idea why (for now) AVMs come short and cannot substitute a CMA that a real estate adviser will prepare for their clients. Any good realtor will want to talk to the potential seller, ask them the right questions so to find the most accurate information about the house, and do a walk-through before they do a comparative market analysis. After they will most likely visit any for sale houses to compare it with the subject property and only after that they would sit down to do the analysis – look at tax records, pictures, size, etc to make sure that they are comparing apples to apples. And this, seemingly small thing, is the difference between an AVM and a CMA done by a real estate adviser. It’s very possible that in 15-20 years they will find a way how to simulate that human interaction that happens between the seller and the realtor, but until then if you are just curious about your house value, hop on any of the AVM sites and find it out, but if you are thinking to actually sell your house, going to a Realtor is still the best way.

Live in the DMV area and thinking to sell your house? I’ll be happy to do a customized for you CMA and present it to you. Start below by completing that form.

[1] Multiple Listing Service [2] Source [3] https://www.redfin.com/city/12839/DC/Washington-DC/housing-market