The 2024 real estate market revealed a fascinating trend that will most likely continue into 2025: an unprecedented disconnect between buyer and seller price expectations. While it’s natural for buyers to seek lower prices and sellers to aim high, last year showed us something different—a gap that was notably wider than the historical norm.

Having worked in the DC Metro market through 2024, I witnessed this firsthand. Sellers often anchored their price expectations to the market peak of 2022, while buyers were responding to changing market dynamics. Though prices continued their upward trajectory, the pace had slowed compared to previous years.

Now, Clever Real Estate’s latest survey puts concrete numbers to what many of us have been experiencing in the field. Their research reveals a $27,000 gap between what buyers expect to pay ($386,507) and what sellers hope to receive ($413,976) in 2025. These are all national averages, and markets like DC Metro typically see larger gaps due to higher price points, the underlying pattern holds true across different price ranges. But that’s just the beginning of the story.

The First-Time Buyer Challenge

Perhaps the most eye-opening finding is the massive $82,000 gap between seller expectations and first-time buyer budgets. While sellers are looking to get an average of $413,976, first-time buyers are planning to spend around $331,546. This disconnect presents a particular challenge in markets where inventory remains limited and affordability concerns persist.

The Confidence Factor

What makes negotiations particularly challenging is the conviction both sides bring to the table:

- 74% of sellers say they would pull their property off the market if they don’t get their desired price

- 85% of sellers expect to sell at or above asking price

- Meanwhile, 35% of buyers are firmly against paying at or above asking price

An interesting twist comes from repeat buyers, who actually expect to spend more than sellers are asking—anticipating an average purchase price of $436,682, which is nearly $23,000 above the typical seller’s expectation.

Timeline Misalignment

Price isn’t the only area where expectations diverge. The survey revealed a significant gap in timeline expectations:

- 72% of sellers expect to complete their sale in under four months

- 58% of buyers anticipate the process taking longer than four months

- A noteworthy 27% of buyers expect the process to take more than six months, while only 6% of sellers share this expectations

DC’s Complex Market: A Georgetown Case Study

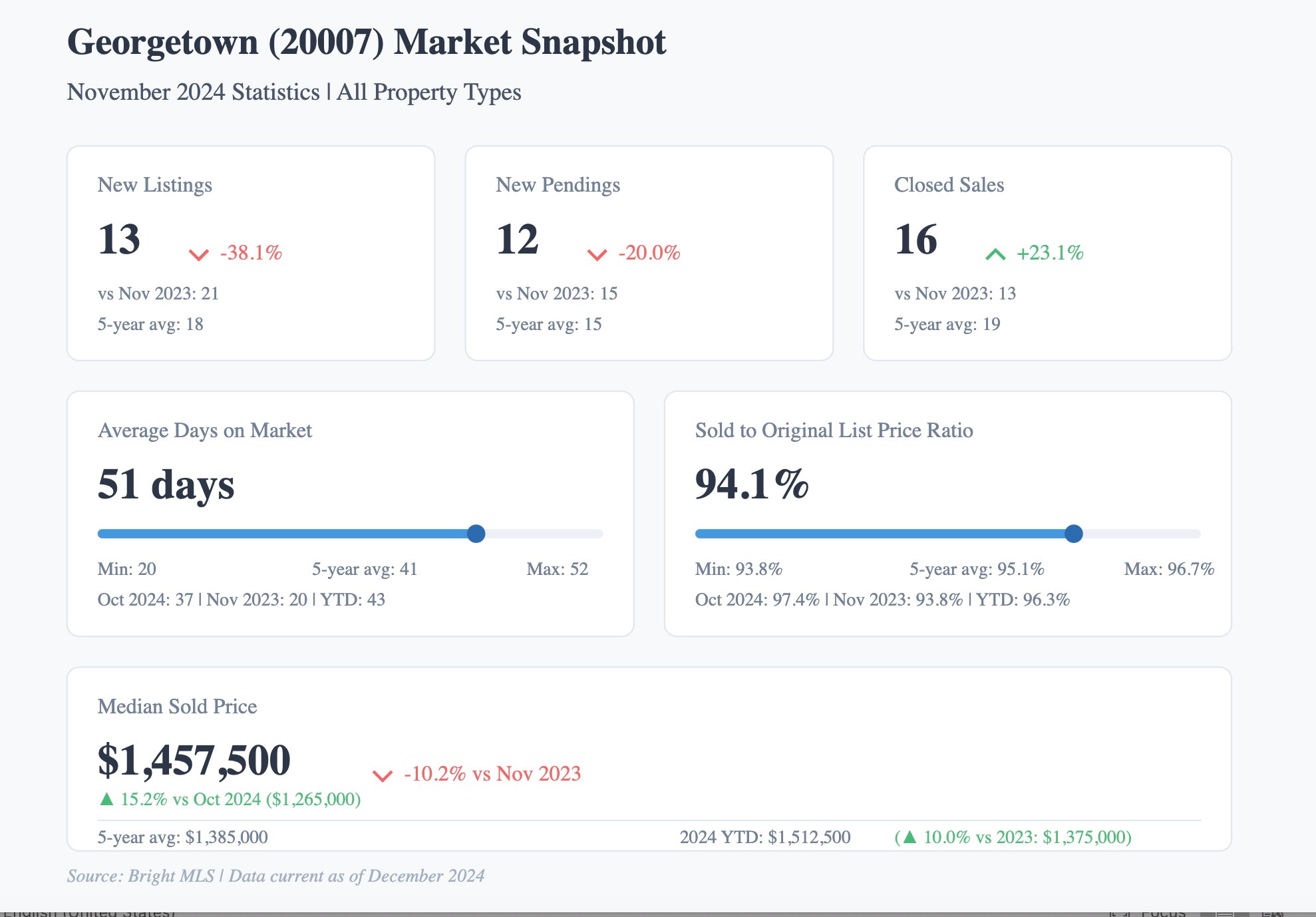

The Washington DC market presents a unique challenge when analyzing buyer-seller dynamics, as the city consists of numerous micro-markets, each with its own distinct characteristics and price points. From Capitol Hill to Petworth, from Dupont Circle to Brookland, each neighborhood operates almost as its own ecosystem. To better understand these dynamics, let’s examine Georgetown, one of DC’s most established and closely watched neighborhoods, as it offers clear insights into the broader market trends. While the neighborhood’s year-to-date median sold price has increased by 10% from 2023 to $1,512,500, supporting sellers’ optimistic outlook, other metrics tell a different story. The average days on market have stretched to 51 days, well above the five-year average of 41 days, and properties are selling at 94.1% of their original list price—clear signs of buyer resistance to aggressive pricing.

Looking Ahead: Market Sentiment & Local Reality

Despite these disconnects, both buyers and sellers share some optimism about the market’s direction. About 45% of buyers and 47% of sellers believe home prices in their local markets will increase.

Is This The New Normal for DC?

Understanding these gaps in expectations is crucial for both buyers and sellers in today’s market, especially in a complex market like Washington, DC. While sellers can point to certain comparable sales to justify higher prices, buyers are increasingly scrutinizing value propositions in light of higher interest rates and affordability concerns. But in a city where government employment provides unusual market stability and where inventory constraints have been a persistent challenge for over a decade—ebbing and flowing but never fully resolving—will this expectation gap finally find its equilibrium, or are we witnessing the emergence of a new normal in DC’s real estate dynamics?

The Georgetown data might offer a clue. While strong fundamentals support continued price appreciation, the days of instant sales at or above asking price are becoming less common.

- For buyers, this market presents a particularly frustrating paradox: while there appears to be more room for negotiation than in recent years, DC’s unique market dynamics and sustained price appreciation significantly limit this flexibility. Success now requires a property-by-property analysis to determine where genuine negotiating opportunities exist, as each listing tells its own story in this complex market.

-

Sellers, meanwhile, face their own balancing act: the temptation to price based on recent comparable sales can be a costly misstep, as today’s market conditions may not support prices from even 3-6 months ago. With buyers willing to wait an average of 51 days and armed with increased market knowledge, an artificially high initial price often leads to larger eventual reductions than if the property had been priced in alignment with current market conditions from the start. As we move further into 2025, the challenge for both buyers and sellers across the DMV will be finding the sweet spot where market reality meets expectations.

As we move further into 2025, the challenge for both buyers and sellers across the DMV will be finding the sweet spot where market reality meets expectations.

HAVE AN AWSOME JANUARY AND HAPPY HOUSE HUNTING OR SELLING!