The real estate market is undergoing a significant transformation. Gone are the days of the ‘unicorn’ years—periods marked by unprecedented demand, historically low mortgage rates, and soaring home values, all intensified by the pandemic. Today, we’re returning to what can be considered a more traditional market landscape.

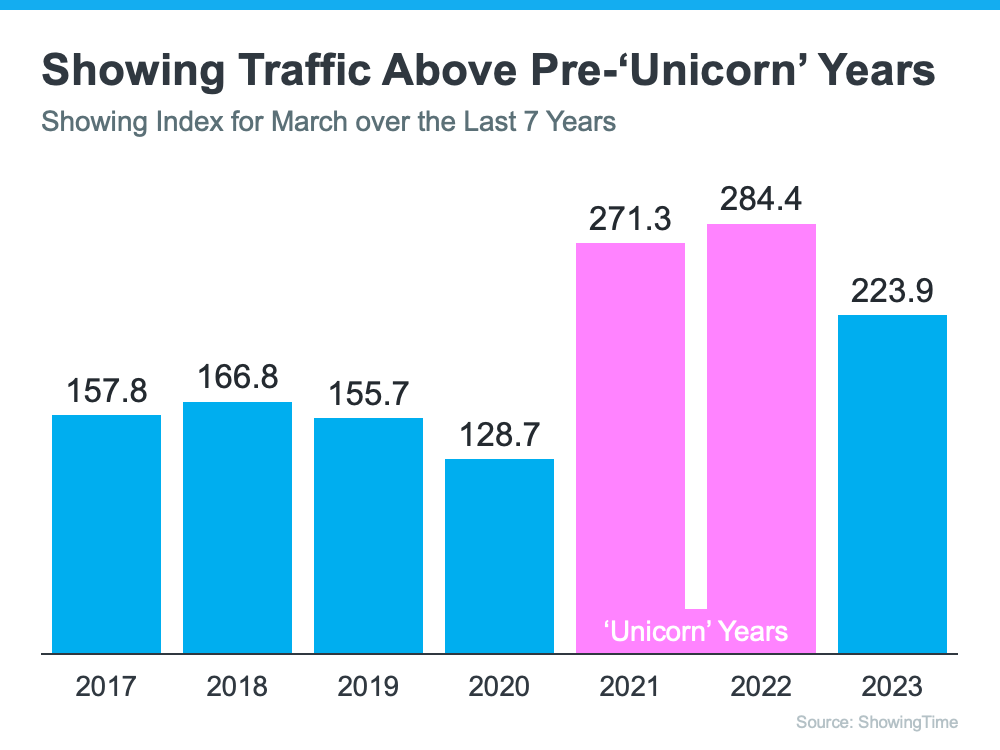

Understanding Buyer Demand

Despite what the headlines may suggest, the market remains active. While demand has cooled compared to the extraordinary past few years, it aligns more closely with the pre-pandemic era, signaling a healthy level of activity.

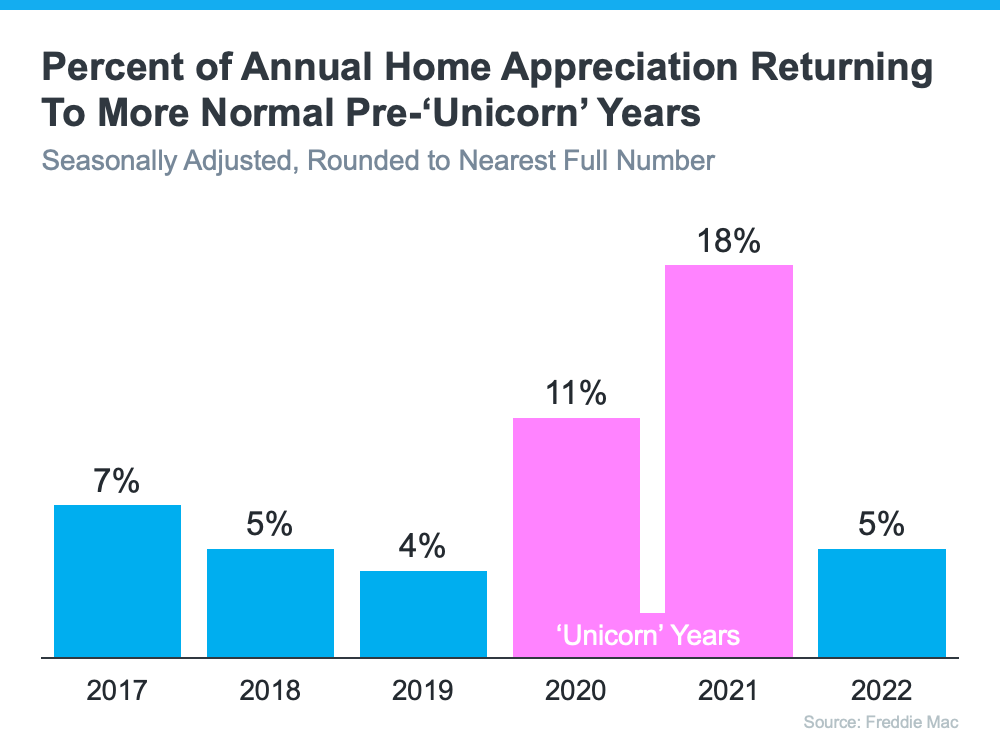

Analyzing Home Prices

The meteoric rise in home prices has normalized. Current trends indicate a return to steady, more predictable appreciation rates, moving away from the spikes observed during 2020 and 2021.

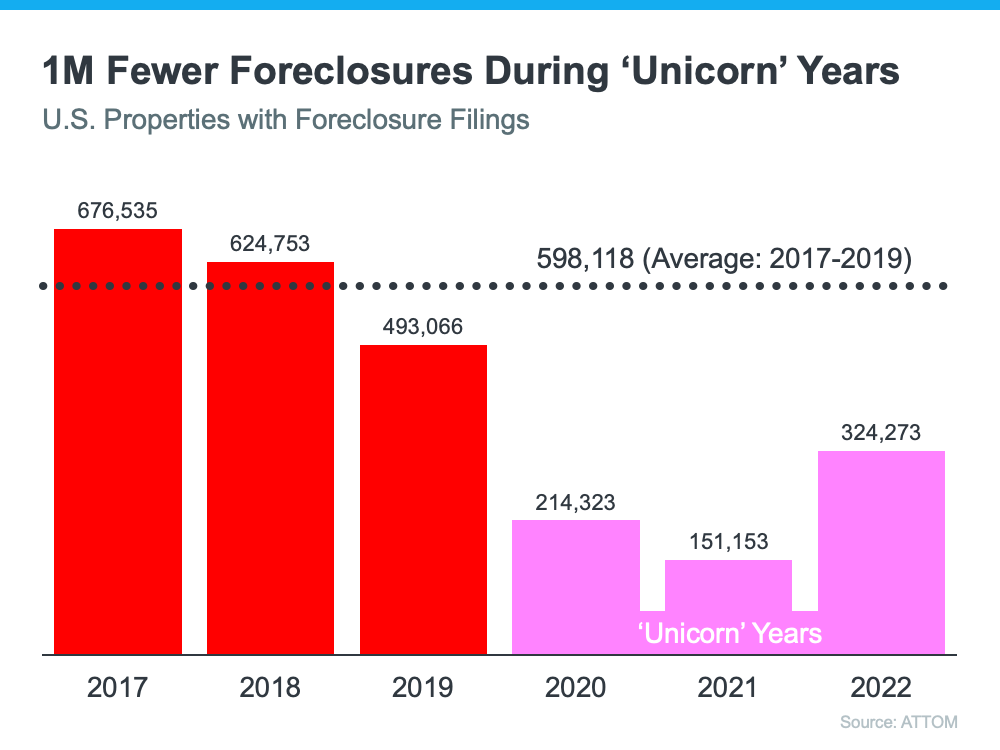

Foreclosure Rates: A Reality Check

Foreclosure filings have seen an uptick, but it’s essential to view these in context. The figures are returning to pre-pandemic levels, reflecting the cessation of foreclosure moratoriums rather than a market downturn.

The Bottom Line

This year, the real estate market narrative will likely be dominated by comparisons to the anomalous recent past. However, understanding the nuances of these changes is crucial for a realistic perspective on what constitutes normalcy in today’s market.

For a detailed analysis and to keep abreast of the latest market trends, click here.