Here’s a glance at what you may expect this spring, according to experts.

1. Mortgage Rates Will Climb

The 30-year fixed mortgage rate has risen by more than a whole percent in the last six months, according to Freddie Mac. Experts predict rates will continue to rise over the next 90 days, despite some minor fluctuations in recent weeks. As Freddie Mac puts it,

“With the Federal Reserve hiking short-term rates and signaling more hikes, mortgage rates are expected to rise throughout the year.”

If you’re a first-time buyer or a seller looking to upgrade to a house that better suits your needs, keep in mind that delaying will almost certainly result in a higher mortgage rate. And a higher interest rate raises your monthly payment, which can add up quickly over the life of your loan.

2. Housing Inventory Will Increase

Buyers looking for a home may soon be able to breathe a sigh of relief. According to Realtor.com, the number of newly listed homes has increased in each of the last two months. In addition, the National Association of Realtors (NAR) recently reported that the months’ supply of inventory has climbed for the first time in eight months. The inventory of existing houses often increases in the spring, and recent activity suggests that the next 90 days may bring more listings to the market.

If you’ve been disappointed by the lack of available homes for sale, it appears that you may be able to find some respite this spring. If you do find the appropriate home, though, be ready to act swiftly.

If you’re a seller, it makes sense to list now rather than wait for the added competition to hit the market. As more homes come on the market, your bargaining power in any subsequent negotiations will be weakened.

3. Home Prices Will Rise

Prices are always determined by supply and demand. Though the number of homes entering the market is increasing, buyer demand remains very strong. As realtor.com explains in their most recent Housing Report:

“During the final two weeks of the month, more new sellers entered the market than during the same time last year. . . . However, with 5.8 million new homes missing from the market and millions of millennials at first-time buying ages, housing supply faces a long road to catching up with demand.”

What does that mean for you? With the demand for housing still outpacing supply, home prices will continue to appreciate. Many experts believe the level of appreciation will decelerate from the high double-digit levels we’ve seen over the last two years. That means prices will continue to climb, just at a more moderate pace. Most experts are predicting home prices will not depreciate.

Won’t Increasing Mortgage Rates Cause Home Prices To Fall?

While some people may believe a 1% increase in mortgage rates will impact demand so dramatically that home prices will have to fall, experts say otherwise. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“What I will caution against is making the inference that interest rates have a direct impact on house prices. That is not true.”

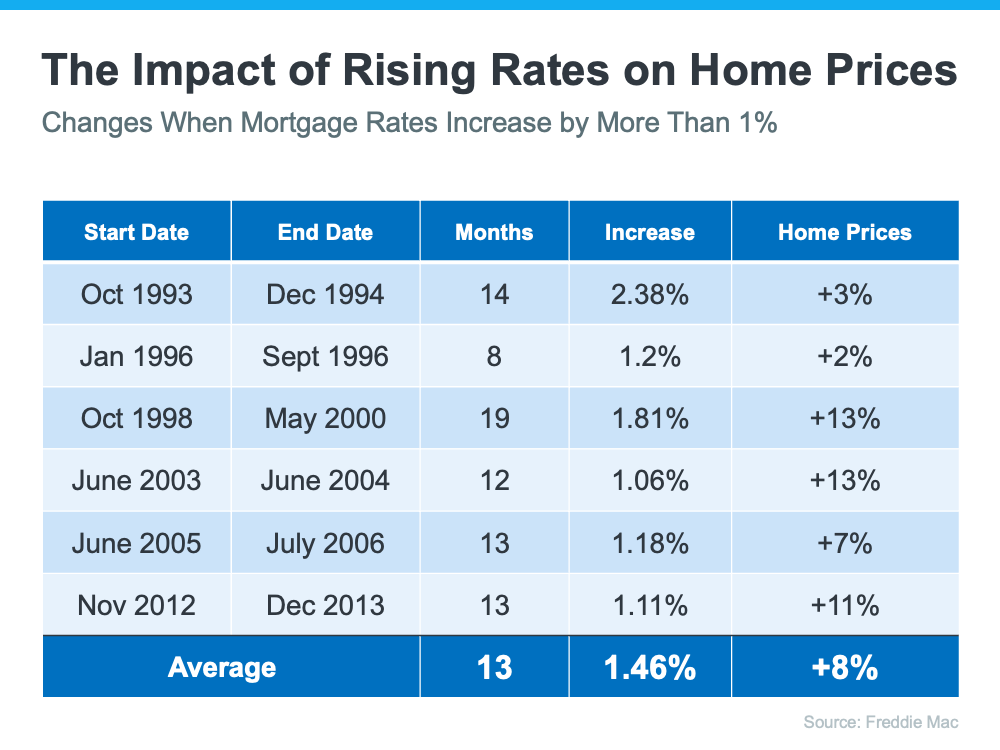

Freddie Mac studied the impact that mortgage rates increasing by at least 1% has had on home prices in the past. Here are the results of that study:

As the chart shows, mortgage rates jumped by at least 1% six times in the last thirty years. In each case, home values increased.

So again, if you’re a first-time buyer or a repeat buyer, waiting to buy likely means you’ll pay more for a home later in the year (as compared to its current value).

Bottom Line

There are three things that seem certain going into the spring housing market:

- Mortgage rates will continue to rise

- The selection of homes available for sale will modestly improve

- Home prices will continue to appreciate, just at a slightly slower pace

If you’re thinking of buying, act now before mortgage rates and home prices increase further. If you’re thinking of selling, your best bet may be to sell soon so you can beat the increase in competition that’s about to come to market.